Get Your FREE Ultimate Guide to 2024 CPF Today! Download Now

QuickHR HRMS software is a pre-approved digital solution for Enterprise Singapore’s Productivity Solutions Grant (PSG) and a Skills-Future Enterprise Credit (SFEC) supportable programme.

Find out about the different grants available today and discover the best HRMS software in Singapore.

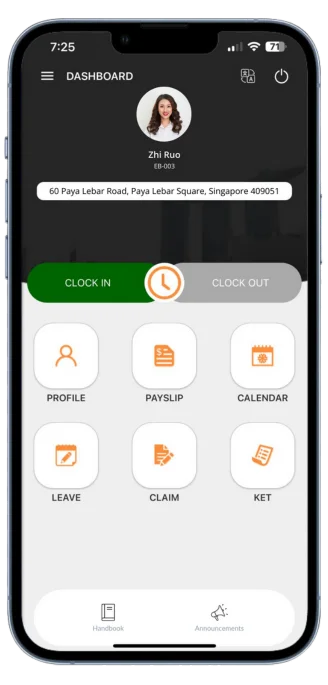

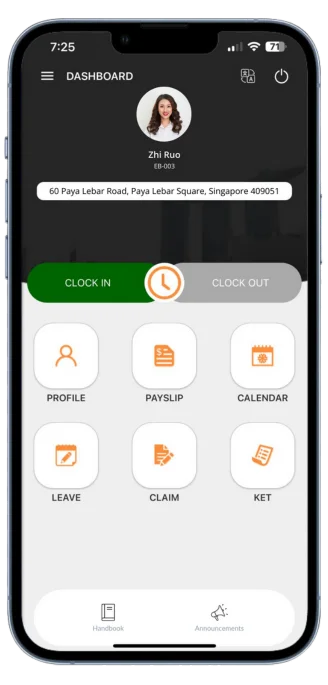

View your itemized payslips on-the-go and get notified when your leaves or claims are approved with our best hr & payroll software.

Save time and reduce errors with QuickHR’s best HR employee management software integration with popular accounting software's QuickBooks and Xero. Automatically send data from QuickHR HR system to your favourite accounting software for easy fit into your workflow.

Come find out what these teams already know

See what our clients say about our HR Software with Payroll

Sign Up to an Award-Winning HR Software for Payroll that’s specifically designed to make human resources more human.